Pcb Monthly Deduction Table 2024

Pcb Monthly Deduction Table 2024. Additional tax deduction under section 80eea (2024) there is an additional deduction of up to rs 1.5 lakh available under the section 80eea on the home loan. Personal income tax rates and thresholds (annual) tax rate.

Personal income tax rates and thresholds (annual) tax rate. June 20, 2023 by admin.

June 20, 2023 By Admin.

China residents income tax tables in 2024.

Pcb Is Deducted From Employees’ Salaries, And Employers Are Responsible For Ensuring The Accurate Deduction Of The Required Amount.

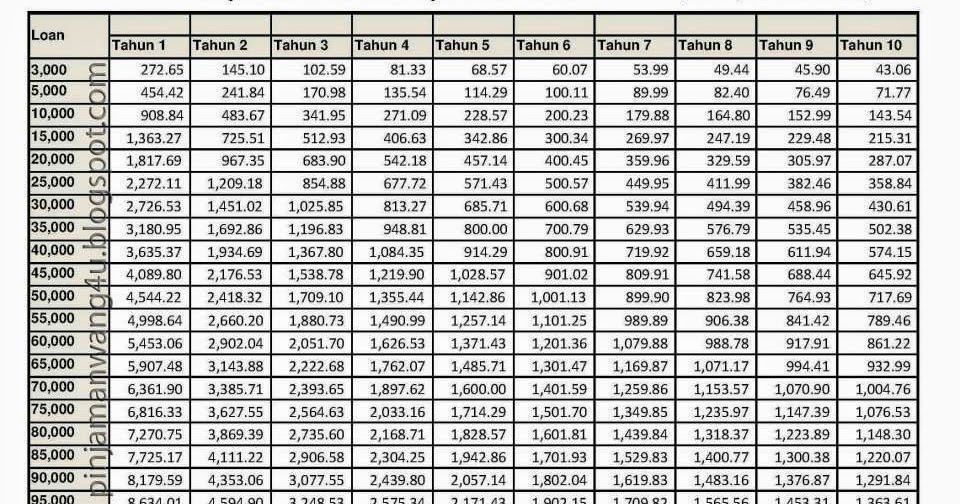

Using the software does not need in depth knowledge of how to calculate the monthly deductions pcb and generate all other report as required by the regulatory authorities.

Submission And Monthly Tax Deduction (Mtd) Payment.

Images References :

Source: qa1.fuse.tv

Source: qa1.fuse.tv

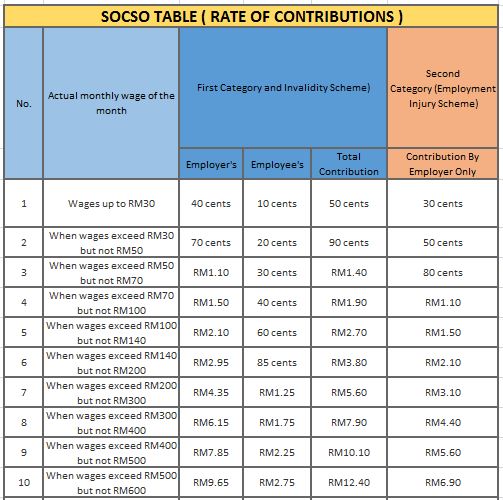

Pcb deduction table 2022 🍓What Is Pcb Malaysia?, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes you file in april 2024) and the 2024 tax year (the taxes you file in. Mtd is a mechanism where the employer deducts the employee's salary on a monthly basis for the purpose of paying the employee's income tax.

How To Pay Tax Malaysia / Tax Amnesty Waiver And Remission Of, A t least two players suffered serious injuries in a road accident involving some national women’s team members earlier this month after. Using the software does not need in depth knowledge of how to calculate the monthly deductions pcb and generate all other report as required by the regulatory authorities.

Source: help.althr.my

Source: help.althr.my

How is PCB calculated in altHR, Additional tax deduction under section 80eea (2024) there is an additional deduction of up to rs 1.5 lakh available under the section 80eea on the home loan. Here’s a simple breakdown of how to calculate pcb:

Source: kissiewzarah.pages.dev

Source: kissiewzarah.pages.dev

2024 Tax Brackets And Deductions kenna almeria, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes you file in april 2024) and the 2024 tax year (the taxes you file in. Here’s a simple breakdown of how to calculate pcb:

Source: sherrywdru.pages.dev

Source: sherrywdru.pages.dev

2024 Standard Deductions And Tax Brackets Helene Kalinda, Using the software does not need in depth knowledge of how to calculate the monthly deductions pcb and generate all other report as required by the regulatory authorities. Pcb is deducted from employees’ salaries, and employers are responsible for ensuring the accurate deduction of the required amount.

Source: www.ccs-co.com

Source: www.ccs-co.com

HASiL New Tax Rates to be Used in Computing Monthly Tax Deduction (PCB, Using the software does not need in depth knowledge of how to calculate the monthly deductions pcb and generate all other report as required by the regulatory authorities. A t least two players suffered serious injuries in a road accident involving some national women’s team members earlier this month after.

Source: pcaxit.blogspot.com

Source: pcaxit.blogspot.com

Pcb Contribution Table 2018 Apa Sebenarnya 'Employee EIS' Kat Dalam, June 20, 2023 by admin. Personal income tax rates and thresholds (annual) tax rate.

Source: goopenelopemathis.blogspot.com

Source: goopenelopemathis.blogspot.com

pcb table 2019 Penelope Mathis, The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2023 tax year (the taxes you file in april 2024) and the 2024 tax year (the taxes you file in. Pcb is deducted from employees’ salaries, and employers are responsible for ensuring the accurate deduction of the required amount.

Source: alomelaniesharp.blogspot.com

Source: alomelaniesharp.blogspot.com

jadual potongan cukai bulanan 2018, Submission and monthly tax deduction (mtd) payment. A t least two players suffered serious injuries in a road accident involving some national women’s team members earlier this month after.

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

Married Federal Tax Withholding Table Federal Withholding Tables 2021, China residents income tax tables in 2024. Using the software does not need in depth knowledge of how to calculate the monthly deductions pcb and generate all other report as required by the regulatory authorities.

Here’s A Simple Breakdown Of How To Calculate Pcb:

A t least two players suffered serious injuries in a road accident involving some national women’s team members earlier this month after.

Pcb Is Deducted From Employees’ Salaries, And Employers Are Responsible For Ensuring The Accurate Deduction Of The Required Amount.

Personal income tax rates and thresholds (annual) tax rate.